Estate Planning for a Child With Special Needs: What Parents Need to Know

Estate planning matters for every family. But when you have a child with special needs, the conversation becomes deeper, more personal, and more long-term. You are not just planning for childhood. You are planning for a lifetime.That reality can feel overwhelming. And yet, thoughtful planning is one of the most powerful ways to protect your child’s future - emotionally, physically, and financially - if you are no longer able to do so yourself. At its core, special needs estate planning focuses on two essential questions: Who will care for your child? And how will your child be supported financially?

Common Estate Planning Mistakes That Cost Families More Than They Expect

DIY and low-cost estate planning options can feel like a smart, efficient choice. The documents look professional, everything is signed, and it seems like the job is done.

The problem is that most estate planning mistakes are not obvious. They are structural. And they often aren’t discovered until a family is already dealing with loss.

When reviewing estate plans created online or by attorneys who do not regularly focus on estate planning, the same patterns appear again and again. The intentions are good, but the execution is often wrong or incomplete.

When Your Child Turns 18, Everything Legally Changes

As parents, we spend years making medical and financial decisions for our children without a second thought. We sign permission slips, speak with doctors, manage insurance, and handle paperwork as needed.

But did you know that the moment your child turns 18, that legal authority disappears? Even if your child still lives at home. Even if you still pay their bills. Even if they still call you for advice.

Legally, they are now an adult.

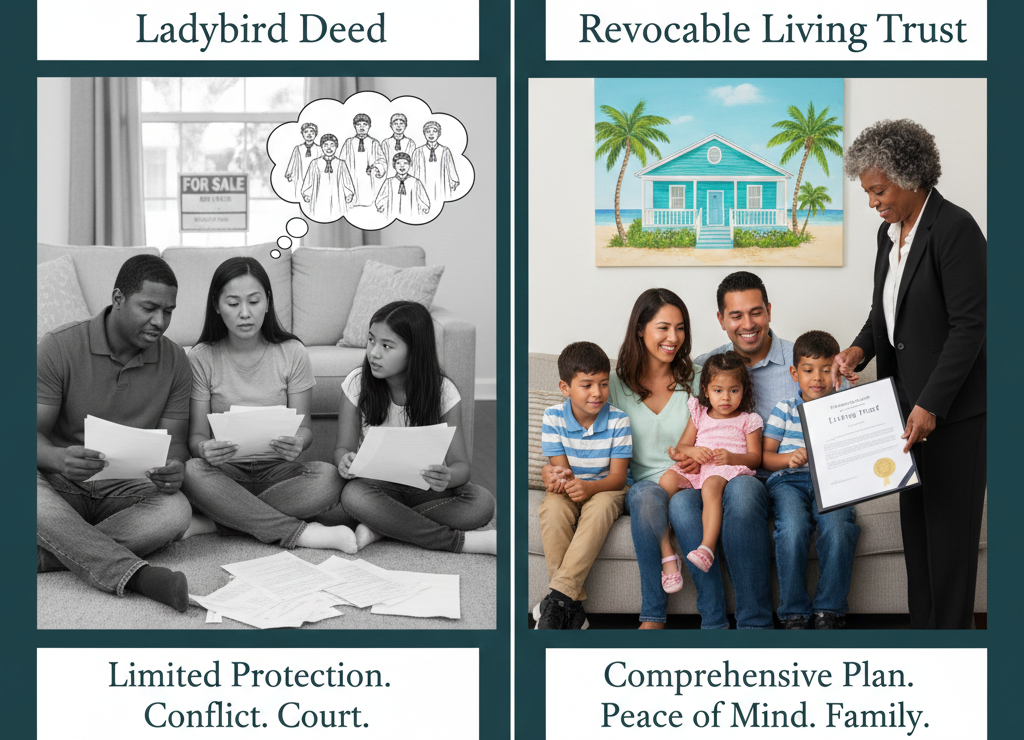

Lady Bird Deeds vs. Revocable Living Trusts in Florida: Which Is Right for Your Estate Plan?

If you own a home in Florida, you’ve probably heard about ladybird deeds as a way to avoid probate. Many Florida homeowners consider them an easy, low-cost estate planning solution.

But while a ladybird deed can work in limited situations, it often falls short of providing the protection families actually need.

As a Florida estate planning attorney, I frequently help clients compare ladybird deeds vs. revocable living trusts

Should You Create Your Will Online? Read Before Clicking “Download”

If you search online for “create a will,” you’ll find dozens of websites promising fast, cheap, even free estate planning documents. And yes, you can legally create a will online.

But here’s what most of those sites don’t explain: a poorly designed or improperly executed will can be worse for your family than having no will at all.

Before you rely on an online will, there are a few critical questions you need to ask.

What Happens to Your Debt When You Die and How to Protect Your Family

One of the questions I hear most often is: What happens to my debt when I die? Or, just as often: What happens to my parent’s debt?

The answer is: it depends. And whether that answer causes stress for your family - or peace of mind - comes down to planning.

Debt doesn’t magically disappear

Who Will Take Care of You as You Age? Why Planning Ahead Matters

Many people assume that when they need help later in life, a spouse, child, or close friend will step in. But that assumption is becoming increasingly risky. Today, more than 16 million Americans over age 65 live alone, and most have no formal plan for long-term care or decision-making support as they age.

Can AI Really Draft Your Estate Plan? What Families Need to Know

Artificial intelligence (AI) has made huge strides in the past few years, bringing futuristic technology into our everyday lives. Tools like ChatGPT can already write emails, brainstorm marketing ideas, answer questions, and even help with educational programs. It’s natural to wonder: could AI eventually replace the work of estate planning attorneys? And more importantly, is it safe to trust a computer with something as important as your family’s future?

We decided to put AI to the test by asking ChatGPT

Estate Planning for Military Families: What You Need to Know

Military families live with realities most civilians never have to think about - sudden deployments, frequent moves, unpredictable schedules, and the everyday risks that come with serving our country. Those constant changes make protecting your family especially important, and often a simple, one-page will isn’t enough to cover everything your family may need. Here’s what every military family should know so you can feel confident, prepared, and protected,wherever the military takes you next.

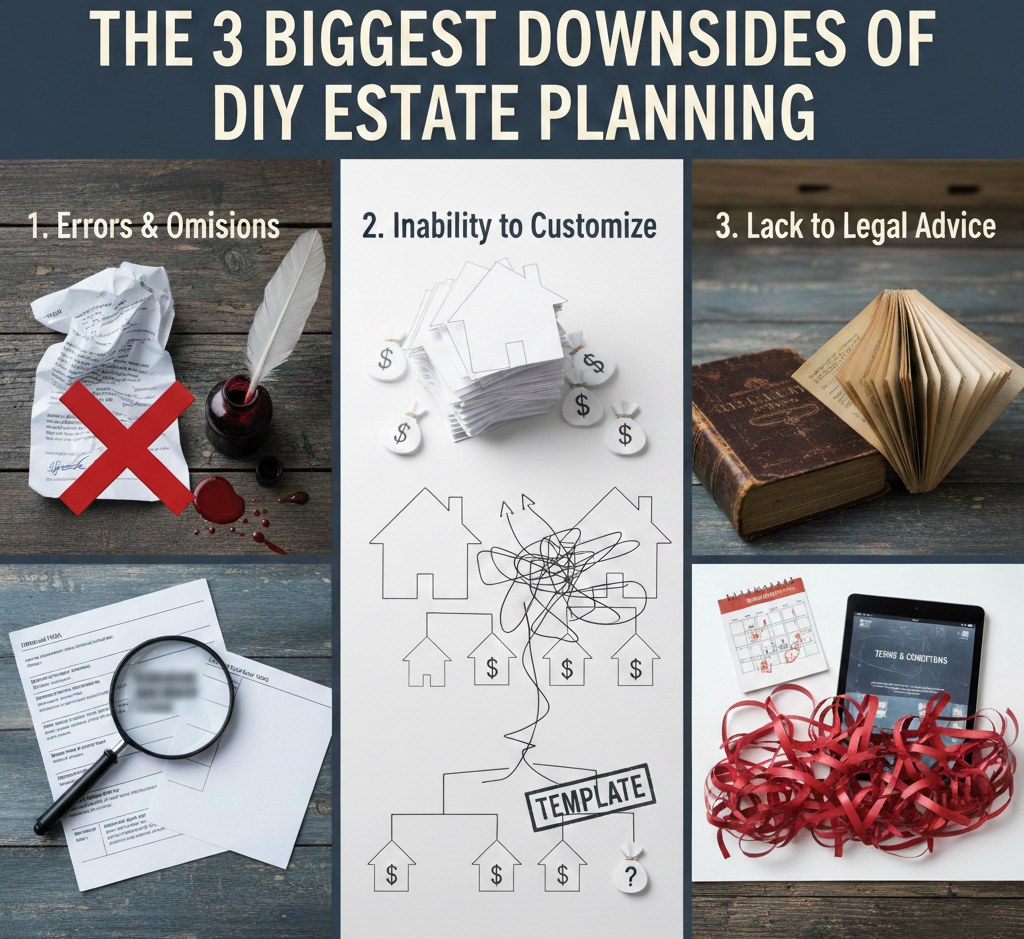

The 3 Biggest Downsides of DIY Estate Planning

With so many online options for creating your own will and estate planning documents, it’s tempting to go the DIY route. While this might seem quick and affordable, there are some major drawbacks to consider. Here are 3 big reasons to think twice before tackling your estate planning alone:

The Estate Tax Is Changing in 2026 — Here’s What That Means for You

There’s a major change coming in estate planning, and it may affect your family without you even realizing it. Right now, the federal estate tax exemption — the amount you can pass on without paying any estate tax — is $13.99 million per person in 2025. But starting January 1, 2026, that number is expected to drop by about half, to somewhere between $6–7 million per person (exact amount to be adjusted for inflation).

This means many families who were previously under the threshold could suddenly be facing a large estate tax bill.

What Is an Executor—and Why Choosing the Right One Matters

When someone creates a will, one of the most important decisions they make is choosing the executor - the person legally responsible for carrying out the instructions in the will after they pass away.

Many people pick an executor quickly, almost as an afterthought, without fully understanding what the role involves. But serving as an executor isn’t just a formality or a title. It’s a serious job, with legal responsibilities, deadlines, paperwork, and emotional complexity.

Estate Planning Has Changed: Why Most Families Now Choose Living Trusts Over Wills

Estate planning used to be simple: you met with a lawyer, signed a will, and called it a day. But the world, and the law, have changed. Fast-forward to today, and more and more families are choosing living trusts instead of traditional wills. Here’s why.

Life Insurance: The Most Overlooked Tool in Your Estate Plan

Most people think life insurance is just about replacing income - a safety net to make sure your family can pay the bills if something happens to you. And yes, that’s part of it.

But here’s the real secret: life insurance can be one of the smartest ways to create instant wealth for your family and keep your estate plan running smoothly.

When someone passes away, even a well-organized family can face unexpected costs.